Enhancing Performance with the Commercial Registration Electronic System for Company Formation

Enhancing Performance with the Commercial Registration Electronic System for Company Formation

Blog Article

Browsing the Facility World of Firm Formation: Insights and Methods

As business owners established out to browse the detailed globe of business formation, it ends up being important to furnish oneself with a deep understanding of the complex subtleties that define the procedure. From selecting the most ideal organization framework to making certain rigorous legal compliance and developing reliable tax preparation methods, the path to creating a successful business entity is filled with intricacies.

Service Structure Selection

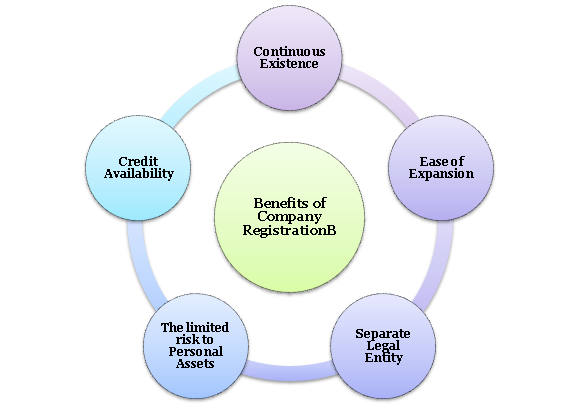

In the realm of business formation, the crucial decision of picking the proper service structure lays the foundation for the entity's legal and functional structure. The option of company framework significantly affects various facets of the company, including tax, obligation, management control, and compliance demands. Entrepreneurs need to very carefully assess the offered choices, such as sole proprietorship, collaboration, limited responsibility company (LLC), or corporation, to determine one of the most ideal structure that aligns with their organization goals and scenarios.

One usual structure is the sole proprietorship, where the service and the proprietor are taken into consideration the same legal entity. Comprehending the nuances of each service framework is crucial in making an informed decision that sets a strong foundation for the business's future success.

Legal Compliance Basics

With the structure of a suitable business framework in position, guaranteeing legal compliance basics becomes critical for securing the entity's operations and preserving regulatory adherence. Legal compliance is important for business to operate within the boundaries of the law and stay clear of potential penalties or lawful concerns. Secret legal compliance basics consist of obtaining the required permits and licenses, sticking to tax obligation policies, executing appropriate data protection measures, and following labor legislations. Failure to adhere to legal needs can lead to fines, legal actions, reputational damages, and even the closure of business.

To ensure legal conformity, companies need to on a regular basis assess and update their procedures and policies to show any kind of adjustments in laws. Looking for lawful advise or conformity specialists can further help companies browse the intricate lawful landscape and remain up to day with advancing laws.

Tax Obligation Planning Considerations

Additionally, tax planning ought to include approaches to make use of available tax obligation incentives, deductions, and credit ratings. By strategically timing income and expenditures, services can potentially reduce their gross income and general tax concern. It is likewise critical to remain notified about adjustments in tax obligation laws that might impact business, adapting strategies as necessary to stay tax-efficient.

In addition, global tax planning factors to consider may emerge for companies running throughout boundaries, entailing intricacies such as transfer rates and international tax credit histories - company formation. Seeking advice from tax professionals can assist browse these ins and outs and develop a thorough tax strategy customized to the company's demands

Strategic Financial Administration

Purposefully handling funds is an essential facet of steering a firm towards lasting growth and earnings. Effective financial management entails a comprehensive technique to overseeing a firm's cashes, investments, and total economic health. One crucial element of tactical monetary monitoring is budgeting. By creating comprehensive spending plans that straighten with the company's objectives and goals, organizations can Full Article allocate sources efficiently and track performance versus economic targets.

An additional critical aspect is capital monitoring. Monitoring cash money inflows and discharges, taking care of capital properly, and guaranteeing sufficient liquidity are necessary for the everyday procedures and long-lasting feasibility of a business. Furthermore, tactical financial management entails threat analysis and mitigation strategies. By identifying financial risks such as market click here for more volatility, debt threats, or regulative changes, firms can proactively carry out measures to safeguard their economic stability.

In addition, monetary coverage and analysis play a crucial duty in strategic decision-making. By creating accurate monetary records and conducting thorough evaluation, businesses can get valuable insights right into their economic performance, determine locations for improvement, and make notified critical choices that drive sustainable development and productivity.

Development and Growth Approaches

To propel a business in the direction of boosted market presence and earnings, strategic growth and development techniques have to be diligently devised and implemented. One efficient strategy for growth is diversification, where a firm gets in new markets or offers brand-new items or services to minimize risks and take advantage of on arising opportunities. It is vital for companies to perform extensive market study, financial analysis, and danger analyses before beginning on any type of development approach to ensure sustainability and success.

Final Thought

Finally, browsing the complexities of firm development calls for cautious consideration of organization structure, legal conformity, tax preparation, monetary management, and development techniques. By purposefully choosing the right organization structure, ensuring lawful compliance, preparing for taxes, taking care of finances properly, and executing growth methods, companies can establish themselves up for success in the competitive service environment. It is necessary for businesses to come close to company development with a comprehensive and calculated mindset to accomplish long-lasting success.

In the realm of business development, the critical decision of picking the ideal organization structure lays the structure for the entity's lawful and functional framework. Entrepreneurs need to carefully assess the readily available options, such as sole proprietorship, collaboration, restricted liability company (LLC), or company, to establish the most suitable structure that straightens with their business goals and scenarios.

By developing detailed budgets that align with the company's purposes and objectives, businesses can assign sources efficiently and track performance against click this site financial targets.

In final thought, navigating the complexities of business formation needs cautious consideration of service structure, legal compliance, tax obligation preparation, economic monitoring, and development methods. By purposefully choosing the ideal organization framework, making certain lawful conformity, preparing for taxes, managing finances effectively, and implementing growth approaches, firms can set themselves up for success in the competitive organization setting.

Report this page